Top 10 Outstanding Vape Brands and Manufacturers(2024 Update)

September 16, 2023

German Vape Market: Pod Vape System Return to the Market?

September 19, 2023The current situation of Indonesia’s vape supply chain and the reasons for its rapid rise.

As a long time. Shenzhen, China has been regarded as the center of the global vape supply chain and manufacturing industry.

With over 90% of e-cigarettes and vapes are producing from here. This viewpoint has been widely recognized in the global vape industry. So that Shenzhen is known as the “vape city”.

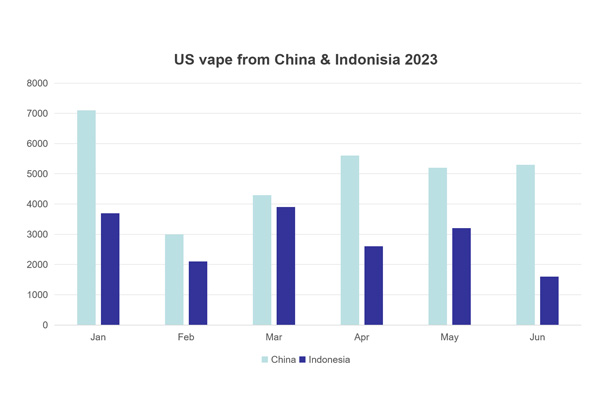

However, according to a data release from the US Trade Commission for June 2023. There seems to have been some changes in the situation. Data shows that in the first half of 2023. The United States import only 63.7% of e-cigarettes from China. And e-cigarettes from Indonesia account for over 35% of its share. This means that Indonesia has surpass other countries and become the second largest exporter of e-cigarettes after China.

In the vape market. Indonesia’s market share is gradually expanding and has become China’s largest competitor.

So, what is the current situation of Indonesia’s vape manufacturing industry? What are the reasons for its rapid rise?

A interview with Shenzhen Jieshibo Technology Co.,Ltd CEO Frank Zhou. He told us: JSB vape world view team research report. Vape industry got something change those years.

First is in July 2022, Smoore, one of the world’s largest vape manufacturer, did build its 14th factory in Malang, Indonesia. The factory covers an area of approximately 6 hectares and has 16 production lines, each capable of producing 7200 electronic cigarette bombs per hour.

Second is the vape accessory supplier Zhijing Precision has also stated that its Indonesian factory has been put into operation in 2022

Thrid is in August 2022, listed company Jinjia group (002191.SZ) reveale on the investor platform. They are building a production base in Indonesia and providing integrated vape services.

Fourth is in January 2023, the international tobacco giant PMI officially complete a $180 million factory in Indonesia, dedicated to producing IQOS HEETS vape pod.

Fifth is on September 11, 2023, South Korea’s largest tobacco producer (KT&G) announce plans to build a new factory in East Java Province, Indonesia, which will begin operation in 2026.

What different between Indonesia and China vape industry market, costs, tariffs?

As the largest economy in ASEAN, Indonesia’s GDP in 2022 exceed 1.3 trillion US dollars, ranking 16th in the world and consider one of the most important and dynamic markets in Southeast Asia.

Under this background,Indonesia’s vape industry has unlimited potential for development. Garindra Kartasasmita, Secretary General of APVI (Asosiasi Personal Vaporizer Indonesia), stated in a public speech at the 2022 Jakarta Exhibition (IECIE) that the vape market in Indonesia has been growing at an annual rate of about 50% since 2013, and decrease 7% in 2021 due to the pandemic. It is expected to rebound and grow by 50% in 2022.

As a labor-intensive market, Indonesia has a well-known advantage of relatively low labor and land costs. However, the main advantage of exporting Indonesian vapes to the United States lies in the US tariff policy.

Looking back in April 2018, the United States did release a list of goods that imposed tariffs on China. The first batch of goods included a total value of $34 billion, including vape products. This measure has led to an increase in the tariff on vape from the previous 6.5% to 31.5%.

And, with the restoration of trade most favored nation treatment in Indonesia in 2020, vape sets exported from Indonesia to the United States only need to pay 2.6% import tariffs. This preferential tax rate undoubtedly further promotes the export of Indonesia’s e-cigarette industry and enhances its competitiveness in the US market.

Finally, with Indonesia’s strong rise, China’s supply chain dominance is facing challenges.